What is Kyber?

As per the whitepaper, “Kyber, is a fully on-chain liquidity protocol for implementing instant cryptocurrency token swaps in a decentralized manner on any smart contract enabled blockchain.” In other words it is a blockchain protocol currently built on Ethereum that allows for the instant conversion of cryptocurrency tokens in a decentralized manner and without the need of an exchange. This in effect makes it extremely easy for someone who just wishes to exchange their ERC20 tokens for another without having to register with an exchange, complete the KYC procedure and then deposit their funds. Thereby creating a seamless exchange process for regular token holders to use that is transparent and allows them to remain in control of their funds.

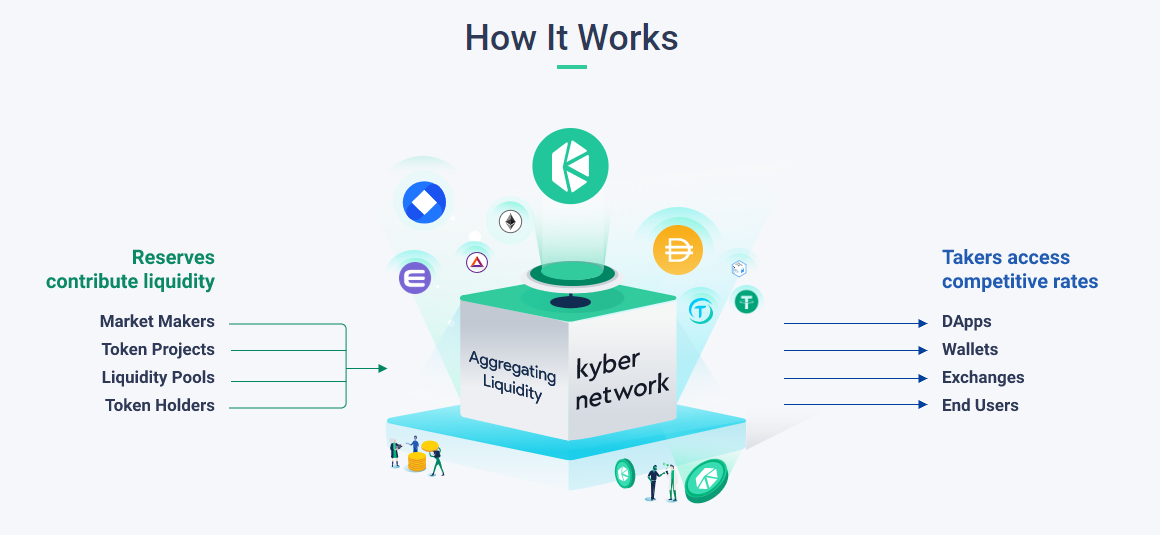

In a nutshell Kyber Network brings together Market Makers and Takers in a decentralized manner using blockchain technology for the exchange of cryptocurrency and tokens, thereby creating a liquidity platform for anyone to then plug into in order to fulfill their requirements.

In order to facilitate the exchange of tokens there needs to be a liquid market and Kyber achieves this by aggregating liquidity from various sources into a single network providing a single endpoint for takers to seamlessly perform multiple token trades in a single blockchain transaction. The Kyber protocol has been designed in such a way that it makes it easy for liquidity providers, end users, decentralized exchanges and other decentralized protocols to then contribute to while also allowing takers, end users, crypto wallets and smart contracts the ability to perform instant and trustless token trades at the best rates available amongst the sources.

The architecture of the Kyber protocol involves the following:

Aggregated Liquidity Pool

Liquidity is taken from various liquidity sources and brought into one liquidity pool, making it easy for takers to obtain the best rates available with one function call.

Diverse Sources of Liquidity

A variety of liquidity sources can be tapped into. Liquidity providers may employ different strategies and different implementations to contribute liquidity to the protocol.

Permissionless

The protocol is designed to be permissionless so that any developer can build different types of reserves, and any end user can contribute liquidity.

The key feature of the Kyber Protocol is the facilitation of token swaps between takers and liquidity sources, where liquidity sources can be as diverse as market makers, token teams, exchanges and individual contributors. Takers refer to anyone who calls the smart contract functions to trade tokens. This can be traders, application users, wallets, or other protocols. Reserves are any individual or entity that wishes to provide liquidity. The protocol therefore aims to fulfill the following properties for token trades:

Instant Settlement

Trade matching and settlement occurs in a single blockchain transaction, which then results in orders being fulfilled without any delays. This enables trades to be part of a series of actions occurring in a single smart contract function.

Atomicity

Trades are either fully executed or reverted as they are not reliant on being filled by a single buyer/seller but instead uses the full availability of Kyber’s reserves (liquidity providers). This also eliminates any subsequent risks from partial trades.

Public Rate Verification

Rates being offered by reserves can be verified by anyone and have their trades instantly settled just by querying from the smart contracts.

Ease of Integration

Trustless and atomic token trades can be directly and easily integrated into other smart contracts, thereby enabling multiple trades to be performed in a smart contract function.

In practicality, the Kyber protocol is implemented as a set of smart contracts on any blockchain that fits the requirements. Reserves are also essentially smart contracts with a pool of funds that the Kyber protocol interacts with. And that all reserves are controlled by different parties with different prices and levels of funding. Instead of using order books to match buyers and sellers to return the best price, the Kyber protocol looks at all the reserves and returns the best price among the different reserves. Currently, Kyber has over 47+ reserves, of which there are 3 main types:

- Automated Price Reserve (APR) and Fed Price Reserve (FPR), are dedicated liquidity providers for Kyber.

- Bridge Reserve takes liquidity from other on-chain providers like Uniswap, Oasis, and Bancor.

The details of how reserves determine the prices and manage their token inventory is not dictated in the protocol and is entirely up to the reserves, as long as the implementation complies with the Reserve interface which contains the relevant contract functions which reserves are required to conform to. Reserves must register through the reserve interface to have their token pairs listed. Reserves make money on the “spread” or differences between the buying and selling prices. A reserve manager will need to develop their own strategies to decide on token-to-token conversion rates and reserve size. This strategy could be executed by a person and/or a machine and could change over time. It is vital though that the spread is competitive as Kyber automatically sources the best price from their list of reserves. A list of reserves that will be iterated through when rates are queried or to facilitate a trade.

Maintainers are also part of the Kyber protocol and refer to anyone who has permissions to access the functions for the adding/removing of reserves and token pairs, such as a DAO or the team behind the protocol implementation. The initial network maintainers will be from Kyber, but will be increasingly decentralized over time as more developers from the community deploy and implement the Kyber protocol on many other blockchains. At the protocol level, Kyber will be continuing to manage the protocol specs, coordinate collaboration between deployments and build out the overall systems, like the DAO and relay networks (for cross-chain communications).

Kyber Network Ecosystem

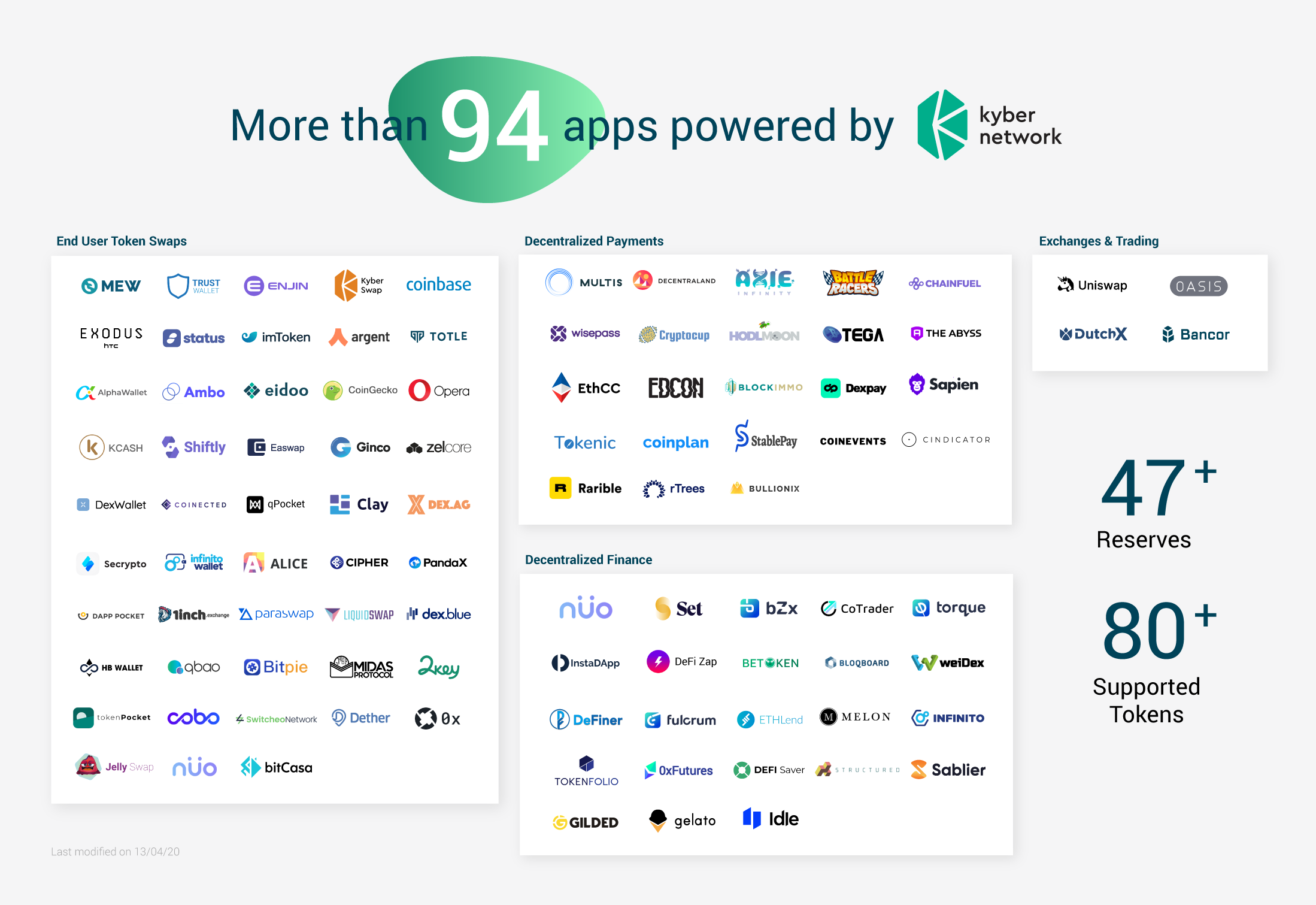

Kyber wants to make it as easy as possible for Developers, Dapps, Wallets, Vendors and even Exchanges to integrate into. It has done this by providing the architecture as described above that allows anyone to incorporate the technology onto any smart contract platform. Presently, Kyber is the most used DeFi protocol in the world, with the highest number of users and integrations, particularly for DeFi applications (Dapps).

Wallets

Decentralized NFT and Ecommerce Payments

Exchanges and Trading Integrations

Decentralized Finance

Kyber Network Crystal (KNC)

KNC is the fuel that powers the Kyber Network and connects different participants in the Kyber Network ecosystem, including both liquidity contributors and other entities that leverage on the liquidity network. It is the native token (ERC20) of the Kyber Network, and being an ERC20 token it can be stored in any ERC20 compatible wallet such as Metamask or MEW.

KNC is used in a variety of scenarios:

KYBERRESERVES

Liquidity contributors

KNC helps to keep the Kyber ecosystem liquid by ensuring reserves are operating to their optimum. 3rd party token reserves are required to purchase KNC to pay for their operation in the network. Kyber Network then charges transaction fees, in KNC, from these reserves. This also acts as a safety barrier to prevent wash trading and market manipulation.

DAPPS / WALLETS / VENDORS

Entities that leverage on our liquidity network

Dapps and Businesses that register themselves and connect into the Kyber Network will earn commissions in KNC after every transaction that they facilitate. For instance, a Dapp platform integrated with Kyber’s APIs will receive referral fees in KNC for directing more users to the network which will help generate greater adoption and grow the ecosystem even further.

NETWORK FEES

In each transaction, a portion of the collected fees (in KNC) on Kyber Network are taken out of circulation forever either by being burned or awarded to integrated Dapps as an incentive to help them grow. This process ensures KNC remains deflationary and while demand is growing this will help to have a positive impact on its value.

KyberSwap

KyberSwap is a retail platform developed in-house that is powered by Kyber’s on-chain liquidity protocol to enable users to buy or sell a wide range of tokens easily through a simple interface. By leveraging the decentralized liquidity pool, transactions on KyberSwap are fast, simple and secure. The platform supports popular wallets such as Metamask, Ledger, Trezor and Torus as well as others.

There is also a mobile version for both iOS and Android.

For a detailed guide on using KyberSwap on your desktop/laptop- Getting Started

For a detailed guide on using KyberSwap on your iOS/Android device- Getting Started

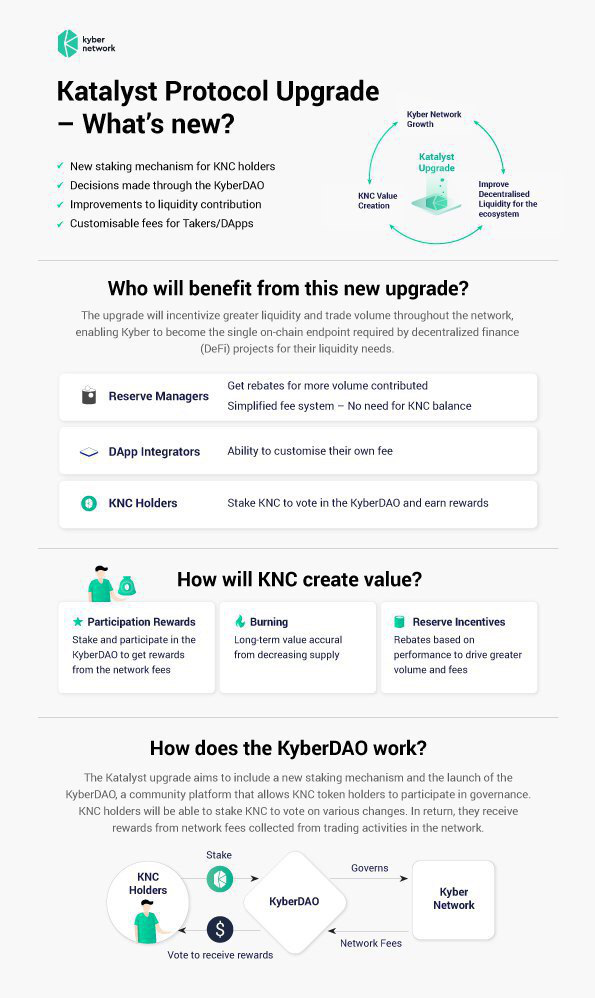

The Future of Kyber and Katalyst

The next big update due from Kyber is the release of its Katalyst upgrade. This upgrade will further expand the use cases for KNC by introducing Staking and create more value. This will then allow KNC holders to receive further tokens in return for their help in governing the network. Governance decisions would include things like transaction fees, the proportion of transaction fees that go towards different things, and listing tokens.

Market Makers too will benefit from Staking as it will allow them to earn tokens for supporting the Kyber network. It is thought that for any ecosystem to thrive and function adequately there needs to be strong incentives for stakeholders to participate, as well as strong alignment towards a common end goal, and this is what Kyber is aiming to achieve with Katalyst.

This Kyber protocol upgrade is meant for 3 key groups of Kyber stakeholders:

Reserve Managers who provide liquidity to Kyber

DApps who connect takers to Kyber’s protocol and of course,

KNC holders who are at the heart of Kyber Network

Kyber will introduce a new staking mechanism that will allow KNC holders to receive part of the network fees by staking KNC and participating in the KyberDAO. And as mentioned previously, Katalyst will also help Reserve Managers as part of the total fees collected will go towards incentivizing reserves based on the amount of trades and volume they bring into the network. This type of incentive, known as rebates in traditional finance, is a well-known and widely used mechanism to attract market makers. Along with this, reserves will no longer be required to maintain a KNC balance for fees, instead network fees will be automatically collected in every trade and burnt or used for rewards and incentives making it easier for reserves to participate in the ever-growing Kyber ecosystem.

Dapp integrators will have the ability to set their own spread according to their business model. Making this significant change will again help to attract more Dapp developers to build with Kyber and create a more tailor-made UX.

It is important to note that any KNC holders who do not wish to participate in governance will still be able to earn rewards by delegating their tokens and voting power to staking platforms. Reputable platforms such as Trust Wallet, imToken, RockX Miner and Hyperblocks have already expressed their support for KNC staking. Existing investors in Kyber Network, such as #Hashed and Signum Capital will also be participating in governance. All of the above changes will contribute in further cementing Kyber as the go-to liquidity layer in DeFi.