What is UniLend?

There is a limitation with existing DeFi platforms at present, in that they act as a gatekeeper in selecting which projects to be a part of their pool which means other viable assets are blocked and unable to participate in the DeFi ecosystem. UniLend does not behave in such a way and allows for a permissionless listing which enables any ERC20 token to be listed making it a truer decentralized and fairer platform.

In conjunction with permissionless listing, the UniLend platform incorporates spot trading functionality for its users allowing them to trade their assets in-platform, meaning users don’t have to leave the platform for this specific requirement. These two unique features make UniLend a very appealing product as they are the first DeFi platform to do this. Other features of the UniLend platform include:

- Flash Loans – Will support all listed tokens and 70% of the fees collcted will be distributed as staking rewards. UniLend’s Automated Staking Rewards pool will also maintain a more uniform reward distribution across multiple blockchains. In addition to this, there will be an Airdrop feature which will allow anyone to instantly airdrop tokens to pool participants. Recent testing has shown Flash Loans to be ~3x more cost efficient than other popular protocols such as Aave.

- Lending and Borrowing – Assets can be used as collateral to be borrowed against as well as for lending to earn interest.

- Liquidity – By becoming a liquidity provider (LP) users are able to receive fees in proportion to their liquidity pool stake, allowing participants to earn additional tokens on idle assets.

- Governance – The UniLend protocol will be governed through its token holders via proposals ensuring that any adjustments to the protocol are made with a majority consensus.

- Native Utility Token – The native utility token of UniLend will be $UFT the UniLend Finance Token. This token will have numerous use cases for governance, platform utility and much more.

The UniLend Team

As for the team in charge of the Unilend project, they have a wealth of experience that I strongly feel will help bring the platform to fruition. The Co-founder and CEO Chandresh Aharwar was Vice President of Marketing and Strategy at Matic Network, another successful and popular crypto based project. He therefore brings a lot of knowledge and experience to the table from his work at Matic. Suryansh Kumar is the CTO and prior to this co-founded MetaTransact protocol, which is also another crypto platform that allows users to pay gas fees in tokens instead of Ether. And Tarun Malik who is their CPO also co-founded MetaTransact together with Suryansh. Together with the other team members, UniLend can achieve big things in the Defi realm.

UniLend Features

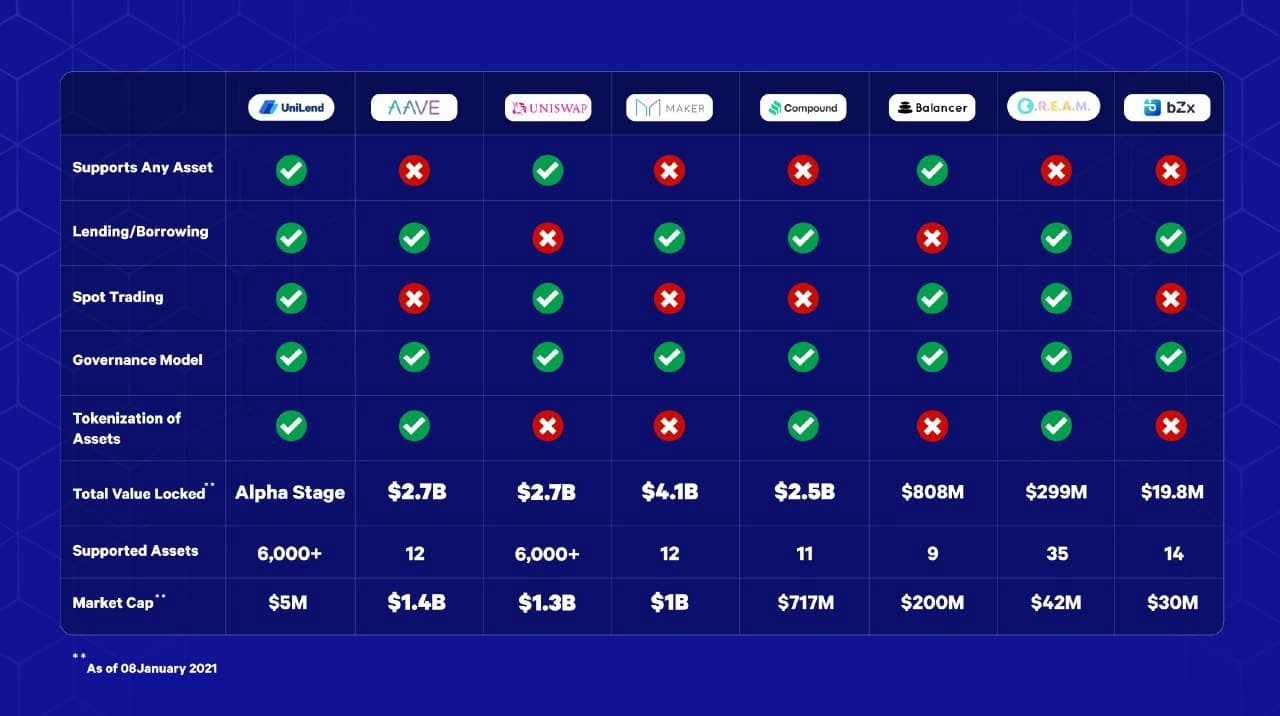

there are already some established DeFi Dapps, however all have a missing functionality and thus do not provide that all in one solution that will cater for various DeFi users. This means users will have to keep swapping between those Dapps that will help fulfil their requirements. UniLend will offer a more complete solution to cater for the DeFi community as a whole, where they will offer:

Borrowing and Lending

Permission-less Listing

Spot Trading

Governance Model

Tokenization of Assets

How Does UniLend Compare?

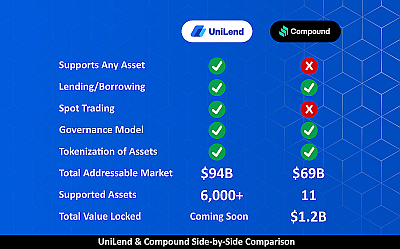

UniLend Vs Compound

Compound does not have the ability to support any asset without the involvement of community proposals and voting, UniLend on the other hand allows users to list any Ethereum-based asset in a permission-less manner. Spot trading is another feature missing from Compound which UniLend have incorporated that will allow users to participate in decentralized spot trading of listed assets.

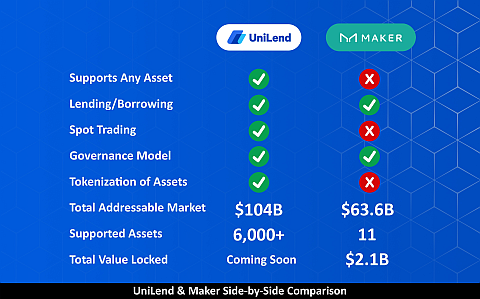

UniLend Vs Maker

The differences between UniLend and Maker are quite distinguished, Maker primarily centres around the stablecoin DAI and therefore is limited in the number of assets it supports. There is no spot trading facility as the Maker protocol’s main initiative is to regulate the DAI supply, therefore their lending and borrowing services will pay any interest in DAI as well generate DAI against collateralized assets. UniLend’s money market on the other hand is a free market, where any ERC20 token can be listed, borrowed and lent out as well as traded.

As someone who has used the Oasis.app platform, which is Maker’s DeFi Dapp I can say that it is rather limited and not very exciting to use.

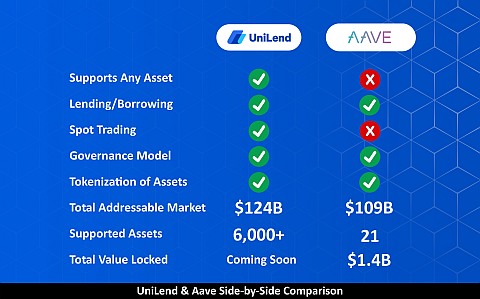

UniLend Vs Aave

Aave is one of the largest cryptocurrency money markets currently and has been growing in popularity since its inception, playing an important role in the world of DeFi. And they have managed to achieve this without incorporating 2 features that I feel are critical to DeFi- the support of any ERC-20 asset and spot trading. By not having the mechanism to provide a permission-less listing means Aave are limited in the number of assets they can list and therefore limited in the type of user they attract. And by not offering the ability to spot trade in-platform will more than likely result in users going elsewhere for this facility. UniLend have opted to have an in-platform spot trading facility and this is something that I feel is better to have than not have and will result in users not having to leave the platform for this feature. It is important to recognise that Aave have come a long way in a short span of time and are continuously pushing the boundaries in the space.

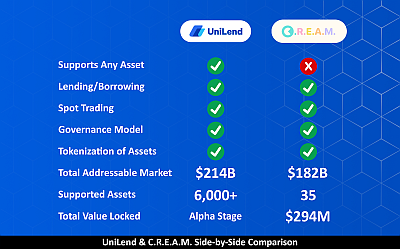

UniLend Vs Cream

When comparing UniLend with Cream Finance the main difference is that Cream does not support the listing of any asset without first going through a governance process, whereas UniLend does not making it easier for users to list assets. Based on user feedback it also seems that while Cream does have the ability to trade assets, users can only do so if they are providing liquidity to the said token, which can act as a hinderance. In addition to this, there is also an issue with the lend/borrow feature as users must make many transactions in order to achieve their goal, again making it difficult for users to participate in. UniLend have recognised these issues with the Cream Finance UX and have confirmed that their UX will be seamless.

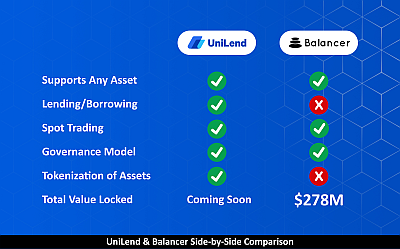

UniLend Vs Balancer

From the image above the main differences between UniLend and Balancer is that Balancer lacks lending and borrowing services as well as the option for users to tokenize their assets. Borrowing and lending services is a fundamental part of DeFi as it allows users to borrow against their assets by using it as collateral, and also earn interest through lending it is therefore great to see that it will be part of the UniLend protocol. Tokenizing ones assets will also play a big part for users as it permits them to unlock the farming potential of any assets they hold. Farming is the process of obtaining extra tokens by providing liquidity to liquidity pools enabling the user to maximise returns on their holdings.

It is important to note that UniLend recognise the Balancer DEX platform as one of the leaders in the space so much so that $UFT can be traded seamlessly on the Balancer protocol.

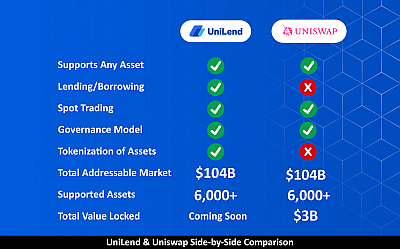

UniLend Vs Uniswap

Uniswap at the time of writing is the most popular decentralized exchange according to DeFi Pulse based on the Total Value Locked (TVL) but still does not offer users a complete one-stop shop for their DeFi needs. As Uniswap is essentially a DEX it does not offer any borrowing or lending services, whereas UniLend places huge emphasis on being a platform that allows people to borrow and lend any ERC20 asset. UniLend also intend on being an interoperable platform meaning that they will be able to list assets from other blockchains and not be restricted to just Ethereum. The main similarity to point out is that both platforms allow for permission-less listing, permitting users to list any token onto the platform creating a free market for trading tokens and increasing liquidity. I believe this is an important attribute to have for any platform as it opens up the platform to a much larger market and will give users flexibility.

Unilend have openly acknowledged that they hold Uniswap in high esteem especially as they are the current market leader for DEXs, and as a result have taken inspiration from them which is definitely understandable and a great thing for them to do. But UniLend are also expanding on this by opening up their platform to those who wish to borrow or lend their assets as well as tokenize them. which will cater for those who want this facility creating a truer DeFi experience.

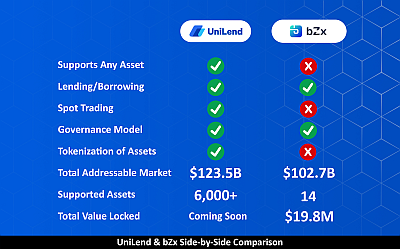

UniLend Vs bZx

From the image above, bZx is missing 3 key features and thus denying these benefits to their users- the ability to support any asset, spot trading and the tokenization of assets. With UniLend they will be supporting any ERC-20 based asset which opens the market up for users making it more appealing knowing they can trade practically any asset without any restrictions. UniLend will also permit the tokenization of assets making it possible to farm additional tokens in return.

Partnerships

CyberFi

CyberFi is a non-custodial intelligent automation platform that is reshaping the DeFi experience. This partnership with UniLend will make all their tools accessible to UniLend users, which includes automation tools that will allow users to automate their lending and borrowing as well as execute a borrow or lend position on a token based on a specified price. It is thought that the tools CyberFi is integrating into the UniLend ecosystem will add immense value to the community making it much more convenient and efficient especially as it allows for smart lending solutions.

CoinDCX

UniLend has entered into a strategic collaboration with Coinbase funded CoinDCX, India’s largest and safest cryptocurrency exchange with daily trading volumes exceeding $15 million. Through this collaboration, CoinDCX users will have access to new DeFi capabilities, powered by UniLend from directly within the exchange and includes UFT farming. CoinDCX is spearheading the crypto revolution for both retail and industry players and has chosen to become UniLend’s official liquidity provider.

3Commas

3Commas is a cryptocurrency trading tool platform with the goal of making trading easy via automated trading bots. They are now looking to break into the DeFi space via their collaboration with UniLend. The 3Commas platform works with most major cryptocurrency exchanges and includes features such as dollar-cost averaging bots, portfolios, and more. They will thus be bringing this suite of sophisticated tools to the UniLend protocol including the Smart Trade Bot, which enables traders to take profit, utilize stop loss features and sell at multiple targets in a manually automated trading fashion.

Fire Protocol

Fire Protocol enables cross-chain asset support while offering new and robust money markets and DEX/swap features, all while maintaining high speeds, cost-effective transactions, and security via Huobi Eco Chain. The integration with UniLend is set to bring more assets onto the Huobi Eco Chain allowing it to grow frictionlessly alongside those on Ethereum. In addition to this, both teams are working together to explore wrapped $UFT on the Huobi Eco Chain, which will open a vast array of opportunities for holders. Interoperability is also a common interest and both teams agree this will play a big part in the DeFi realm, Fire Protocol has their own cross-chain technology.

Nord Finance

Nord Finance will integrate UniLend Finance into the Nord Advisory portion of their tech stack. This will enable new DeFi investing strategies for the DeFi community. In addition to this, the UniLend protocol will be used in conjunction with Nord’s proprietary algorithm, which ultimately assists with users’ goal-orientated diversified portfolio management. Nord Finance has been designed as a block-chain agnostic platform with multi-chain interoperability, where their aim is to offer users easy access to a plethora of financial products including, but not limited to, yield-farming aggregation, funds management, robo-advisory and loans against assets.

Mirror Protocol

Mirror Protocol enables the creation of synthetic real-world assets, such as stocks. These assets will be able to be lent and borrowed via UniLend making UniLend the world’s first platform to offer decentralized lending and borrowing of stocks. This will open up brand new financial strategies for the decentralized community by allowing for the creation of fungible synthetic assets that track the price of real-world assets, ultimately bringing the world’s assets to the blockchain. This will enable the major global stock market assets to enter into DeFi such as FAANG stocks.

Fantom

UniLend will allow the trading, lending, and borrowing of Fantom native assets, and the Fantom Foundation will provide the liquidity to bootstrap to ensure a smooth launch. Some of the assets that may come to our platform from Fantom are: FTM, fUSD, fGBP, fCNY, fEUR, fKRW, fJPY, fCHF, fBTC, fETH, fLINK, fBAND, fBNB, fGold, fSilver and fWTI. Lending is required for derivatives, and it allows a basic level of longing and shorting on leverage creating a more healthy value. Therefore, listing FTM on Ethereum lending platforms opens up many token syncs such as leveraged yield farming, deeper liquidity for DEXs, and it significantly increases capital utilization for FTM itself because people can get access to exposure in other assets without reducing FTM exposure during short term shakiness.

Union

UNION is joining the UniLend ecosystem and bringing C-OP, a collateral optimization product to UniLend. C-OP will allow users on UniLend to convert a portion of their collateralized position to acquire protection for their collateral. C-OP’s protection mechanism works similar to an American-styled put option. UniLend will be among the first of the decentralized money markets to implement C-OP. To kick things of, UNION will also be listing their UNN token on UniLend.

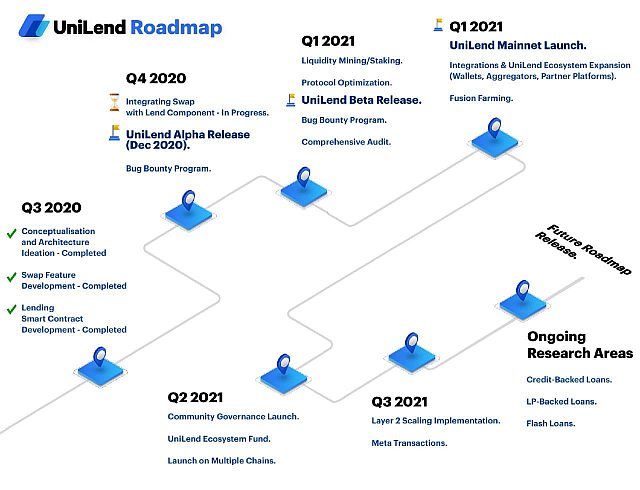

The UniLend Roadmap

Since UniLend’s inception in Q3 of 2020, they have so far completed the following milestones as per their roadmap:

UniLend Swap Feature

This feature consists of an automated market making pool which negates the need for centralized components and maintains the liquidity needed to support trading in addition to lending and borrowing, in a completely decentralized manner.

UniLend Lending Smart Contract

UniLend’s lending smart contract works differently to existing lending protocols and it thus required a complete custom development. This was completed in Q3 of 2020. Instead of going down the normal route of using multi-asset pools, the UniLend protocol consists of separate pools for different assets (multi-pool system). Creating separate pools for each token is an essential architecture-level advancement that opens up UniLend for permissionless DeFi options whilst limiting exposure of lenders and borrowers to any potential risks associated with all tokens in a specific pool.

UniLend’s Alpha Release – Initium is now live

Released on 29th December 2020.

This release contains four main functions relating to the lending and borrowing functionality – Borrow, Lend, Redeem and Repay. Borrow and Repay are functions for borrowers on UniLend, and Lend and Redeem are functions for lenders.

Updates to look forward to in Q1 of 2021:

Liquidity Mining/Staking

Liquidity providers are a key component in ensuring the sustainability of a decentralized finance protocol by facilitating liquidity within the protocol. Once the full-featured platform is launched, LPs will be rewarded for their service with governance rights in the form of UFT tokens, in addition to a percentage of trading and borrowing fees.

UniLend Beta Release

This release will entail the launch of a production-level platform which includes all the comprehensive features of the UniLend protocol.

Comprehensive Audit Report Release

UniLend have been working with the best audit teams in the industry since the early days of the project and they will undergo comprehensive audits to ensure the platform is secure and not prone to any vulnerabilities. This report is then to be shared with the community.

UniLend Mainnet Launch

The fully-featured UniLend protocol/platform will launch towards the end of Q1 of 2021. By this point the protocol will have been battle-tested and will offer all of its comprehensive features, including decentralizing trading, lending/borrowing, and liquidity mining all running on mainnet. UniLend will then be accessible to anyone and everyone for all DeFi functionality.

Integrations and UniLend Ecosystem Expansion

Pending third-party integrations upon launch of mainnet include:

- Wallets – Confirmed Frontier Wallet

- Aggregators

- Partner Platforms (external integrations) – Confirmed partner includes CryptoLocally

- Partner Platforms (internal integrations) – Confirmed partners include OpenDeFi, CyberFi and 3Commas

Fusion Farming

Is a mechanism by which users will be able to attain multiple tokens via liquidity mining for certain assets. Farming campaigns will be initiated for certain projects’ tokens which are listed on UniLend. During these campaigns, users who provide liquidity for specific tokens will be able to secure both UFT and the token in question via liquidity mining.

The Future of UniLend

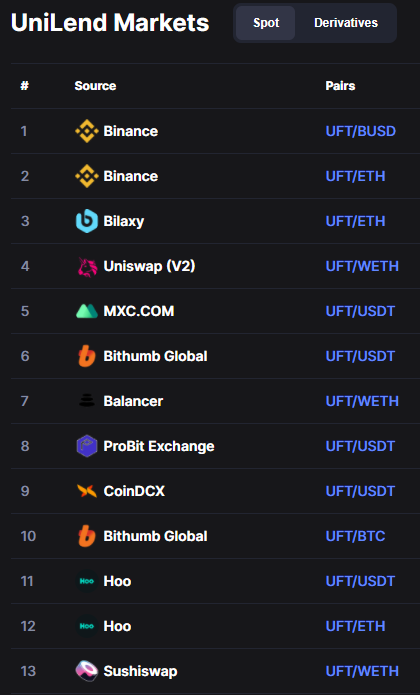

UniLend have clearly made an impact in the DeFi space since their inception just 3 months ago. Within this time they have made important partnerships and integrated with numerous exchanges, this shows they are a serious player in the DeFi sector. They have been listed on India’s biggest exchange CoinDCX and also ProBit in South Korea, with the latter allowing them to tap into a huge market of over 800,000 monthly active users. Many of these partnerships will not only give access to a wider audience but also a broader range of user. India as well more recently have taken a softer stance towards crypto based projects and I believe have recognised their value towards the economy. India is also home to 1.3 billion people where the average age is 29, a prime demographic for DeFi related products.

The UniLend mission is to become a one-stop shop for all your cryptocurrency borrowing, trading or lending needs. They have recognised that existing DeFi protocols will have one specific feature such as lending/borrowing but then lack another, creating a merry-go-round for the average DeFi user that is looking to maximise the potential of their assets. With UniLend they have all the major DeFi bases covered catering to all kinds of users allowing them more control over their assets. The permission-less listing of tokens feature will give users access to over 6000 tokens allowing UniLend to tap into a $16.7 billion untouched market, I should also point out that this is not a standard feature found on most other platforms. The facility to allow spot trading from within the platform will mean users won’t have to leave the platform in order to trade one token for another. The tokenization of assets and governance model will enable users to farm tokens and also vote on key changes respectively.

Borrowing and Lending is the bread and butter of the DeFi world and therefore has been incorporated into the UniLend protocol but now having access to over 6000 token will attract many more users to the platform. Attracting users to the platform is something that the team have really mulled over and have come up with a number of incentives for those who utilize the UniLend protocol from LPs to general platform users. Their governance model will allow $UFT holders to vote on proposals which require a majority consensus to be implemented. Ecosystem participants who use UniLend for lending, borrowing, or trading will be rewarded with governance power in the form of $UFT tokens, the same will go for any LPs. 15% of the total $UFT token supply will be allocated to liquidity mining and yield farming rewards. UniLend have definitely ticked all the right boxes in ensuring their product will reach as many people as possible in bringing the benefits of DeFi to those who want it.

But at the end of the day the crypto industry is about bringing out working products as per the whitepaper and roadmap, and UniLend have stuck to their roadmap with the launch of their Alpha Release- Initium. As mentioned previously this release contains a sleek interface that exhibits 4 main functions relating to the lending and borrowing functionality, it can be found here- https://app.unilend.finance/ . This is a good indication that the team can deliver what they have set out. And therefore I look forward to the launch of the UniLend mainnet towards the end of this quarter Q1 2021. The team leading this project have done extremely well thus far and based on their crypto backgrounds I believe they are well qualified in taking this project to the finish line. I very much look forward to using the platform for maximising any gains especially as UniLend have ensured that all coding will be audited by external teams and this will be a huge comfort to participants. Enter UniLend Finance, the protocol that will enable users to fully unlock the true potential of decentralized finance.

Since this article was written, UniLend have announced they will also be incorporating Flash Loans which is now becoming a key part of the DeFi sphere and therefore a most welcome addition. Flash Loans were made popular by Aave but UniLend have built on this and made their version a lot more cost effective, in some cases up to 3x which will be another attraction for everyday users. UniLend are continuing to bring features that will benefit the majority which is another great sign on their intent in becoming the all-in-one platform for DeFi.