What is DeFi?

DeFi is an acronym that stands for Decentralized Finance and is a movement that allows anyone to access traditional financial services such as borrowing, lending and trading without having to go through a central party. DeFi is one of the fastest growing sectors in the blockchain and cryptocurrency space.

Essentially, DeFi is a group or more specifically an ecosystem of Decentralized Applications (Dapps) that provide financial services on top of distributed networks with no governing authority. Most of these Dapps are being built on the Ethereum blockchain. The goal of DeFi is to overcome the shortcomings of the traditional financial system using trusted protocols and making financial tools more readily available to anyone in the World no matter of their financial and social status.

What is DeFi Trying to Achieve?

In today’s Financial system, banks are the backbone that facilitate payments, accept deposits and offer lines of credit to various qualified people, FIs and even governments. However, not everyone has access to a bank account with the main reasons being their social status, their financial statement and geographical position. Banks are also fundamentally managed by humans and governed by policies which make them susceptible to manipulation and corruption. This was shown to be the case in the 2008 financial crisis.

Therefore DeFi aims to improve the following three key areas of the financial system:

- Payment and Clearance System (Remittance)

- Accessibility

- Centralisation and Transparency

DeFi Applications

DeFi is transforming traditional investment vehicles into their digital form where users can manage their funds directly without the need of any 3rd party involvement. Everything is controlled through programmable rules set within a DeFi Application (Dapp) to provide the below services:

Lending and Borrowing

Compound operates as a liquidity pool that is built on the Ethereum blockchain. Suppliers supply assets to the pool and earn interest, while borrowers take a loan from the pool and pay interest on their debt. Essentially, Compound bridges the gap between lenders who wish to accrue interest from idle funds and borrowers who wish to borrow funds for productive or investment use.

Derivatives

Synthetix is a protocol for Synthetic Assets, known as Synths on Ethereum. Synths track the value of underlying assets and allow exposure to them without the need of holding the asset itself. There are 2 types of Synths: Normal which are positively correlated with the underlying asset and Inverse which are negatively correlated to the underlying asset. Index Synths provide traders with exposure to a basket of tokens without the need to purchase all the tokens. The index will mirror the overall performance of the underlying tokens.

Decentralized Exchanges (DEXs)

Such as Kyber Network, Bancor and Uniswap which are based on liquidity pools for the direct exchanging of tokens via a smart contract address. Order book DEXs like dYdX work in a similar way to CEXs where users can place buy and sell orders at either their chosen limit price or at market prices.

Payment Services

Such as Kyber Network, Bancor and Uniswap which are based on liquidity pools for the direct exchanging of tokens via a smart contract address. Order book DEXs like dYdX work in a similar way to CEXs where users can place buy and sell orders at either their chosen limit price or at market prices.

Fund Management

In DeFi, fund management is conducted in a manner where a fund manager is no longer necessary and instead lets the end user be in command of the asset management strategy that best suits their financial needs. Decentralized fund management also reduces traditional fees that usually have to be paid. A fund management Dapp will have programmed algorithms to conduct trades for you automatically instead of having to do this manually. One such Dapp is TokenSets.

Insurance

Nexus Mutual is a decentralized insurance protocol built on Ethereum that offers cover on any smart contract on the Ethereum blockchain. Currently, Nexus Mutual offers coverage against smart contract failures such as bugs. The coverage may result in protection against financial losses that may be incurred due to hacks or exploits in the smart contract code. Note that smart contract cover only protects against “unintended uses” of smart contracts, so security events such as the loss of private keys or centralized exchange hacks are not covered.

Lottery

DeFi has also impacted the lottery sector by transforming it into a decentralized game where there are no losers. PoolTogether is a decentralized no-loss lottery or decentralized prize savings application where users get to keep their initial deposit amount after the lottery prize is drawn. In a conventional/centralized system the prize money is funded from the lottery tickets purchased, however in PoolTogether the prize money is funded using the interest earned on Compound by the pooled user deposits. For more information on how to participate in PoolTogether please see DeFi – Lottery for detailed instructions.

Stablecoins

Stable coins such as Dai, Tether and USD Coin help protect investors from the volatility of cryptocurrency prices. More about this is explained below.

The DeFi Stack: Oracles

Smart contracts play an important role in the DeFi space and they rely on data from the outside world also known as off-chain data in order to perform accurately and securely. Oracles help to facilitate this by using trusted providers for the feeding of reliable and critical data in a decentralized manner that can also be verified. Band Protocol is one such oracle platform that plays a significant part in financial products such as options, index funds, insurance products, and any other financial vehicles that depend on a robust price feed spot data on-demand from other blockchains and sources. Some other use cases include:

- Decentralized Finance (DeFi)

- Payments for Decentralized Commerce

- Gaming, Gambling, and Prediction Markets

- Supply Chain Tracking

- Identity Layer

- Open Internet API connection

The DeFi Stack: Stablecoins

Due to the current nature of the cryptocurrency market, prices of cryptocurrencies are extremely volatile. Therefore to help minimize the impact of this, stablecoins which are pegged to other stable assets such as the USD were created. The primary use of stablecoins is to help users hedge against price volatility and was created to be a reliable medium of exchange. Due to this characteristic stablecoins have since become a big part of the DeFi space. Currently at the time of writing there are 19 stablecoins with the top 5 stablecoins having a market capitalization totaling over $5 billion. These include: • Tether (USDT) • USD Coin (USDC) • Paxos Standard (PAX) • True USD (TUSD) • Dai (DAI) Tether (USDT) pegs itself to $1 by maintaining reserves of $1 per Tether token minted. This means for every 1 USDT minted there is an equivalent of 1 USD fiat currency backing it. Tether is the largest and most widely used USD stablecoin, however Tether reserves are kept in financial institutions and users will have to trust that Tether as an entity actually have the reserve amounts they claim. Due to this fact, Tether is a centralized fiat-collateralized stablecoin. Dai (DAI) in comparison is collateralized using cryptocurrencies such as Ether instead of fiat based currencies. Its value is pegged to $1 through protocols voted on by a decentralized autonomous organization (DAO) and smart contracts. This then makes it easy for users to validate at any given time. DAI is a decentralized, crypto-collateralized stablecoin. Even though Tether dominates the stablecoin market with approximately 80% of the market share, DAI’s trading volume has been increasing at a much faster rate. This is mainly due to the popularity of DeFi and that DAI is the preferred option. As Ether is part of the Ethereum platform, DAI is native to the Maker platform which runs on the Ethereum blockchain.

Decentralized Exchanges (DEXs)

Centralized exchanges allow participants to buy and sell digital assets in the open market and place large orders with plenty of liquidity. But they do carry an inherent risk as users do not have ownership of their assets. Since 2019 there have been multiple instances of exchanges being hacked and funds stolen due to assets being held in custodial wallets. The alternative to Centralized Exchanges is Decentralized Exchanges also known as DEXs. DEXs work using smart contracts and on-chain transactions to reduce or eliminate the need for an intermediary. They also allow users to have full ownership over their assets. Some popular DEXs include projects like: • Kyber Network • Uniswap • Dex Blue • dYdX

The Future of DeFi

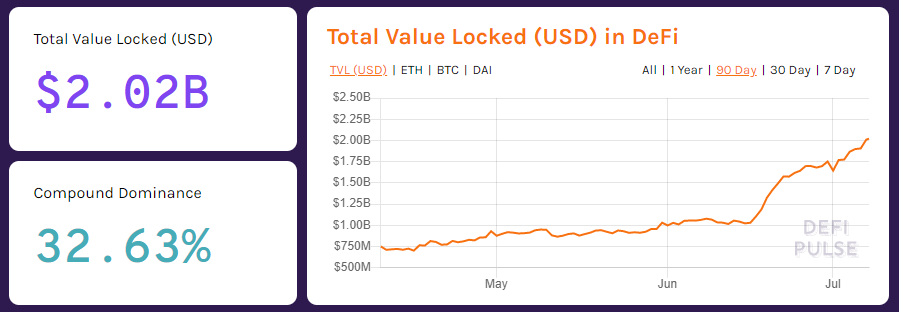

At the start of 2020, the Total Value Locked (TVL) in DeFi Dapps hit the significant milestone of $1 billion. Put another way, this equates to the total amount of programmable money currently stored in smart contracts that serve as the building blocks of an entirely new decentralized financial system on the Internet. Compared to traditional financial markets, $1 billion may be small but it is important to recognise how quickly the DeFi space has grown over the last couple of years:

- 2018 – TVL increased 5 times from $50 million to $275 million

- 2019 – TVL increased 2.4 times to $667 million

- 2020 – TVL reached $1 billion (Feb 2020)

The DeFi Ecosystem

The Ultimate Guide to DeFi

Click Here for the Ultimate Guide to DeFi

The Rise of DeFi

Click Here to read the report by Woodstock Fund